Why INOKS Capital?

INOKS Capital is one of the most experienced players in providing sustainable specialized alternative credit to corporates active in the Agri/Food Sector:

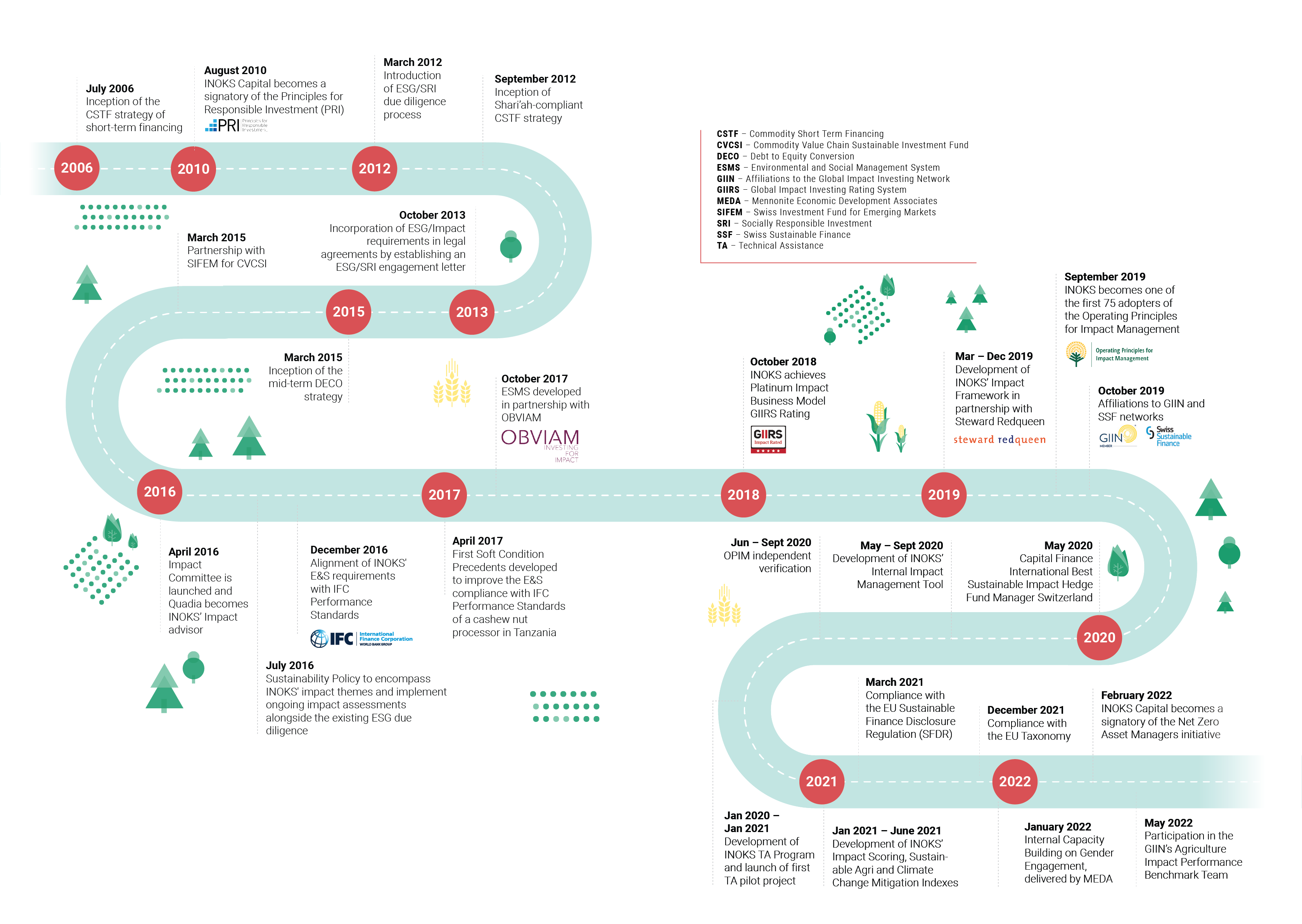

- Long experience (strategy live since 2006)

- Highest regulation (prudentially regulated asset manager by FINMA)

- Inhouse know-how (sourcing, in/di-vesting, structuring, monitoring, workouts)

- Resilience (Agri/Food sector focus on basic nutrious goods)

- Active proprietary investment sourcing & management processes

- ESG/Impact DNA (inherent in the investment process since 2006)